2021 started really well and then got impacted by Fed bank announcements on cuts in asset purchase and interest rate hikes. Now with covid19 omicron variant becoming the dominant variant in Europe and USA, and causing lockdown in Europe, it looks like the stock market will continue to be turbulence in the short run.

My portfolio value exceeded 200k and 250k last year, and briefly crossed 300k this year. However, it is slightly below 300k at the time of writing. A little disappointing, but I am consoled that overall portfolio is still green, with unrealised gains of $25k. If omicron causes more havoc, it would wipe out the unrealised gains and will be a signal for me to tap on my warchest. I am close to tapping into my warchest.

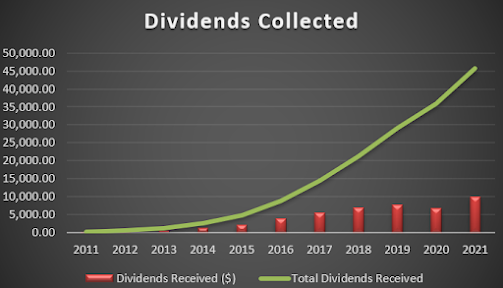

In 2021, I collected $9,973.81 in cash dividends, a 46.6% increase compared to 2020. It would have crossed the $10k mark if I did not participate in scrip dividends for DBS and/or OCBC. But with a long term view in mind, scrip dividends would still be something that I want to tap on for stocks that are fundamentally good. This year, my average cost yield is around 3.84%.

Since I started investing, I have invested a capital of $273,008.66 and current portfolio value stands at $298,532.82 at the time of writing.

In terms of total dividends received over the years, I have received $45,799.59.

This year I made a total of 14 transactions, back to my usual number of transactions made in a year. 2020 was a special year where I made many transactions. 12 were buy/add/scrip transactions and 2 sell transactions.

May the year of 2022 be a different year and not be another Covid19 dominated year. Stay safe and healthy!

Portfolio excludes Singapore Savings Bonds, Foreign Stocks, Crypto and Stashaway