I have been in this journey since 2011 with the aim to generate passive income to off set my daily expenses. During this journey, I found out about Financial Freedom and FIRE (Financial Independence, Retire Early). I hope I can reach such a stage. Since I started the journey, I have learnt several learning points which I thought would be useful to document down these learning points. This would be a useful reminder for me and it could be helpful to you.

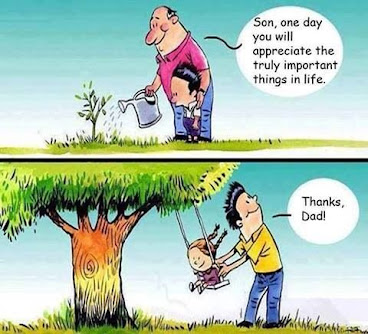

Investing is like growing a plant, you need to give it attention and provide it with tender loving care. Providing it with water, fertilisers and pesticides in adequate amount at the right time. When its leaves and branches are too overgrown, you will even need to prune it.

Your boss or company is not going to plan your retirement and look after you after you retire. When you or your boss leave the organisation, you each go your own way. You are in charge of your own finances, retirement and life. If you do not work on this yourself, no one will and no one can help you.

1) Know yourself

You need to understand yourself. Who are you? What motivates you, your strengths and weaknesses, and emotions. Are you emotional or calm? Are you disciplined and a numbers person, or do you buy on gut feel and hearsay.

What are the reasons you buy a particular stock for? Always fall back onto these reasons before you buy more or sell.

By knowing yourself, you will know your strengths and weakness, and what you should watch out for.

2) Ask yourself whether you are a trader or investor?

If you are a trader, there is no point reading on as I am an investor and everything here is for an investor. As an investor, I am not looking for quick gains. I buy fundamentally sounded stocks and do not monitor their prices frequently unless there are business news that impact it. I intend to hold these stocks until they reach 'freehold' (i.e. dividends cover the stock purchase cost). Unless something fundamentally changes and I do my due diligence, I will cut off the share, even at a loss.

Take for example I cut off Hyflux at a loss of 67.2%! Had I held on to it, the loss would have been nearly 100%.

If you are emotional, then you need to take a timeout when market crashes and ask yourself why you bought the stock and if that reason is still valid. Panic selling will not help you.

3) Do not buy penny shares

Yes, I know that penny shares are cheap and that they are more affordable. When you start your investing journey, you are likely to be FOMO (fear of missing out) and want to flip (make a profit) a few times. But the reality is that you may loss all.

Also, when you start your journey, you only have a limited amount of capital and buying penny shares allow you to buy more number of shares compared to blue chip shares (or those listed in the mainboard).

Penny shares are cheap for a reason. Most of the times, they are small companies. I get it that there are gems such as ifast, but these cases are rare.

|

| Success is not always what you see |

4) Buy blue chips

Blue chip stocks are generally more expensive for a reason. These stocks are from well-known and established company, with track records. Buying them provides me with a peace of mind and allow me to sleep soundly.

Investing in blue chips may not make you rich fast, but it will get you there. Do not rush the process.

5) Never chase dividends yield

There are reasons why a particular stock has high dividends yield. Its yield is high to compensate for a higher risk. If you are buying a stock with high dividends yield, you need to find out why it is offering such a high yield and whether your portfolio can manage the risk.

In 2013, Asian Pay Television Trust IPO and was offering a high dividend yield of around 8.5%. Its IPO price was then 97 cents. Many people were sharing about its high yield and subscribed to it. I did not subscribe due to its declining business. Today, its share price is $0.11, with a yield of 9%.

Need 1 more example? Eagle Hospitality Trust IPO in May 2019 at US$0.78 with a projected yield of 8.2%. Today, its share is suspended after one of its units defaulted on a loan.

6) There is no free lunch

If it is too good to be truth, it probably is. You reap what you sow. You need to do your homework and due diligence. Do you want to plant the seeds now and monitor it or just buy on hearsay or rumours?

7) Observe your surroundings

Instead of using the phone constantly (on the train and bus, and at restaurant and malls etc), observe your surroundings wherever you are. Is the place crowded? Are people spending money or just walking pass or doing window shopping? What are most people using and doing?

Doing this on a constant basis, you will know what is in demand and what is not. This has impact on stock prices.

|

| The more you see the more you learn |

8) Think ahead of others

The stock market is efficient and typically prices move 6 months to a year in advance, in anticipation of the impact on their financial performance.

9) Stop procrastinating

The first step is always hard. If you do not plant the seeds now, you will not get the fruits or tree full of shade years later.

|

| First step is the hardest |

10) Do not be dishearten and do not give up

Investing is a slow and long journey. Know what is your end goal and be realistic about it. Do not give up easily.

My own investing journey was so slow that I questioned myself. But I never gave up and tried and tried. I build my portfolio slowly bit by bit. Today, I am really proud of this portfolio and I hope I am right about this. Time will tell. The journey and lessons learnt have also made me stronger and wiser (I hope),

Let me know your thoughts and learning points too.

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

%20treemap.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

%20treemap.JPG)

.JPG)

%20treemap.JPG)