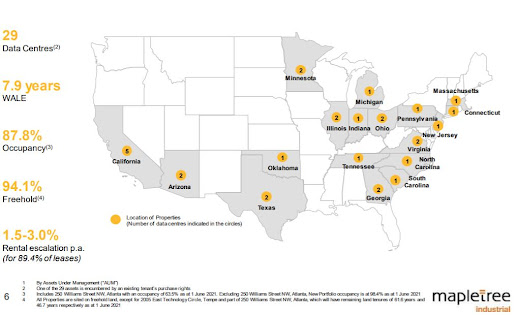

Mapletree Industrial Trust (MIT) has proposed an acquisition of US$1.32 billion for 29 data centres in 19 states in the United States. The acquisition will be funded via equity fund raising and debt. Equity funding will be via Private Placement and Preferential Offering.

Preferential Offering has impact on shareholders. More information on what is to be done can be found at the end of the post under "Indicate Timeline for shareholders".

Details of the acquisition (images are from MIT's presentation slides):

Acquisition Portfolio

One of the 29 properties is encumbered by an existing tenant's purchase rights. This means that if that tenant exercise the right to purchase that property, that property will be excluded from the acquisition. Should that happen, the purchase consideration would be by around US$100 million.

The occupancy is 87.8% as the occupancy in one of the property in Atlanta is 63.5%.

The net leasable area is 3.3 million sq ft and 94.1% of properties are freehold.

NAV and DPU Accreditive

MIT Overall Portfolio

MIT's assets under management (AUM) will increase from S$6.8 billion to S$8.6 billion. AUM for Data Centres will rise to S$4.6 billion from S$2.8 billion. This mean that data centre will be 53.6% of MIT's portfolio. We can expect further Data Centre acquisitions as MIT's target is for Data Centres to be 2/3 of their portfolio.

MIT's WALE

MIT's overall weighted average lease expiry will increase from 4 years to 4.6 years. 12.4% of the lease will expire in current FY.

MIT's Gearing

60% of the acquisition will be funded via debt. This means that gearing will increase from 36.0% to 40.3%.

Indicate Timeline for shareholders

Preferential Offering (PO) application starts from 3 Jun at 9am and ends on 11 Jun at 5pm. Applications for PO can be done via ATMs.

Under this PO, 5 new units can be applied for every 100 existing units. Issue price range is S$2.640.

Example:

If you have 5,000 MIT shares as at 31 May 21, you can apply for 250 new units on 3 Jun.

(5,000/100x5 = 250)

Since you have 50 odd units, you may consider 1 of the following:

a) apply for excess units to round up to hundreds; or

b) apply for just 200 new units (instead of 250).

For myself, MIT is my 4th biggest holding in my portfolio. I am definitely applying for the rights issue along with excess rights. I am not a fan of odd units especially when we talk about PO or rights issue. Also, the acquisition is NAV & DPU accreditive, and increases WALE.

good writeup

ReplyDeleteThank you.

Deletehow should retailer investor subscribe to this right?

ReplyDeleteif your shares are in CDP, you can apply via ATM

DeleteAny ATM will do?

ReplyDeleteyes any ATM

Delete