Transactions made in the month:

- Bought 2,000 units of Keppel DC Reit at $2.69

- Bought 5,000 units of Raffles Medical at $1.15

In the financial world, the term "Sell in May and go away" and reinvest in November is well know as historical data suggested that the best performing months are from November to April. Obviously, for an investor like me who do not time the market, I ignore it and HODL. I added on to Raffles Medical and Keppel DC Reit during the month of April.

With Raffles Medical recent results, I added on in anticipation of its China hospitals doing better financially in the next three years. The Chongqing hospital has seen improvements in patient load and the management expects it to achieve Ebitda break-even in 2022. The Beijing hospital has completed its upgrading to offer more services. The Shanghai Hospital is near completion and will start receiving patients in the 2nd quarter of the year. Each time, a new hospital is set up, there will be a gestation period. I am taking a long term view of it, hence I am adding on to it now. I will probably add more along the way if the price drops. The dividend yield for this stock is expected to be low at around 2%. The management has decided to stop offering scrip dividends this year while is a pity. I would have preferred scrip dividends.

If you are going for dividends you are better off entering Reits. On a side note, currently Raffles Medical is operating 15 vaccination centres out of the 38 centres. They seems to be one of the biggest private operator player in this market. With Singapore on the verge of 2nd wave, MOH is working with private hospital operators again for emergency and inpatient care required.

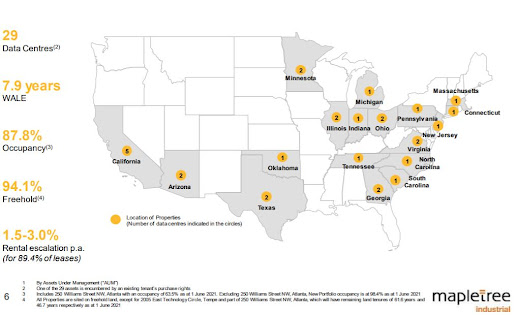

For Keppel DC Reit, I added more units as it announced a solid set of results for Q1 21. DPU for Q1 is $2.462 which is up an increase of 18%. NAV has dropped by 1 cents to $1.18 which means it it trading at 2.2 P/NAV. Not the highest P/NAV as it has traded at 2.42 ratio before. They have completed the Asset Enhancement works at Keppel DC Dublin 2 and DC1.

I did not receive any dividends in the month of April. Will be expecting at least $1,500 worth of dividends in month of May. The actual amount may be lower since I will likely go for scrip dividends for DBS.

Dividends received* during the month: $0

Total dividends received in 2021: $1,353.19

Average dividends per month: $112.77

Total Portfolio Market Value: $297,569

*Dividends are recognised after payment date. Average dividends per month is calculated by dividing the dividends received by 12 months regardless of the month.

Portfolio excludes Singapore Savings Bonds, Foreign Stocks, Crypto and Stashaway